Introduction to Currency Conversion

45.6 billion won to usd Currency conversion is a fundamental process in the global economy, necessary for individuals and businesses engaging in international transactions. The act of converting currency involves determining how much one currency is worth in relation to another, an essential step that affects various aspects of trade, travel, and investment. In today’s interconnected world, understanding currency conversion is crucial for those dealing with international clients or traveling abroad.

The importance of currency conversion can be seen in everyday scenarios. For example, a traveler who wishes to purchase goods or services in a foreign country must convert their home currency into the local currency. Similarly, businesses involved in exporting and importing goods must convert revenues and expenses incurred in different currencies to maintain accurate financial records. This process leads to an understanding of prices, costs, and profit margins, which can significantly impact business decisions.

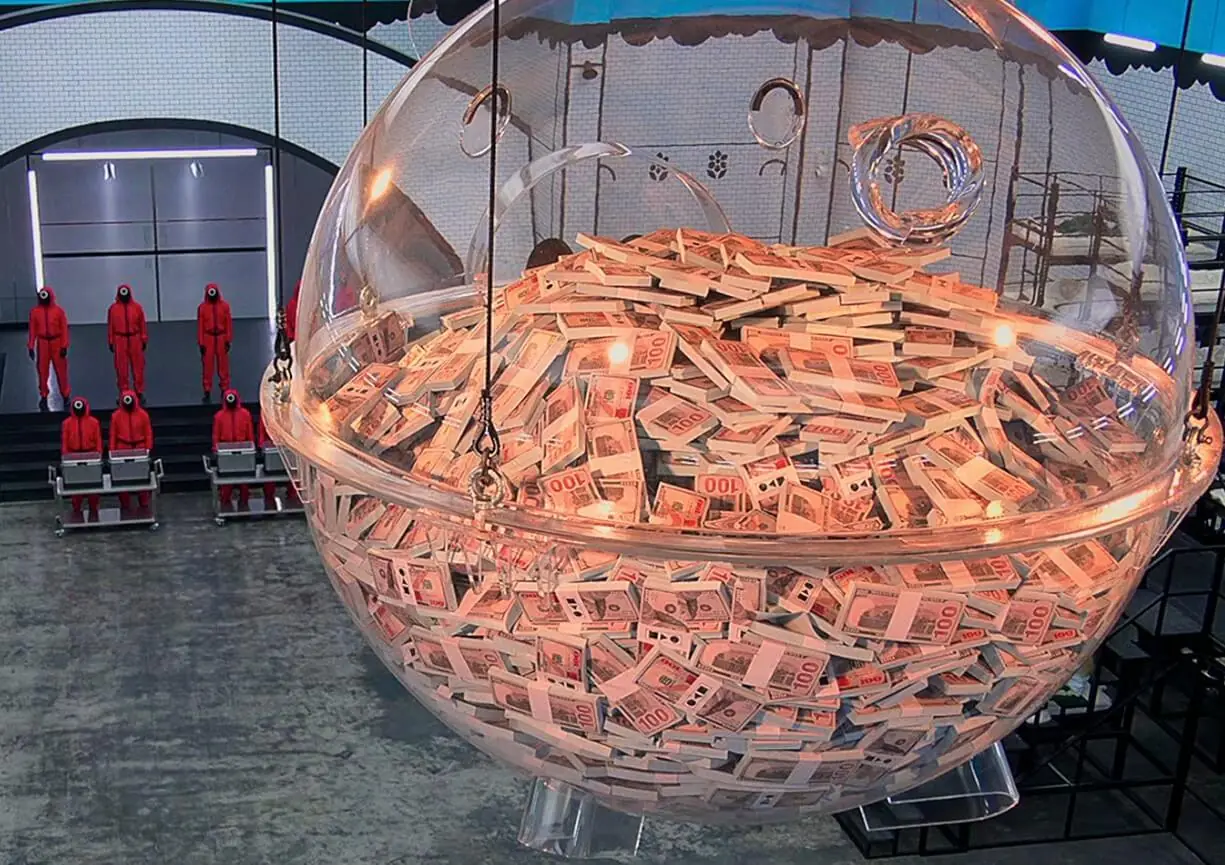

The conversion of 45.6 billion South Korean Won (KRW) to United States Dollars (USD) serves as an illustration of the complexities involved in currency exchange. Exchange rates fluctuate based on numerous factors, including economic indicators, geopolitical developments, and market sentiment. Consequently, the value of the South Korean Won in relation to the US Dollar can change frequently, influencing how much USD one would receive in exchange for 45.6 billion won. It is vital to stay informed about these rates to make knowledgeable financial decisions.

In addition to exchange rates, currency conversion fees imposed by banks and financial intermediaries should also be considered. These fees can affect the final amount received after conversion, making understanding the process even more critical for individuals and businesses alike. Overall, grasping the essentials of currency conversion lays the groundwork for more informed financial strategies, especially when dealing with significant sums such as 45.6 billion won to USD.

Current Exchange Rate Insights

The exchange rate between the South Korean Won (KRW) and the US Dollar (USD) is a vital economic indicator that reflects the relative valuation of these two currencies. As of October 2023, the current exchange rate fluctuates around 1,300 KRW to 1 USD; however, these rates are subject to change due to various factors affecting the foreign exchange market. Understanding the nuances behind exchange rate determination can provide insight into how amounts like 45.6 billion won to usd are calculated and what implications they hold for both short-term trades and long-term investments.

Exchange rates are influenced by multiple dynamics, including inflation rates, interest rates, and the overall economic stability of the respective countries. For instance, if South Korea experiences economic growth while the United States faces recessionary pressures, the demand for the won may increase, leading to a stronger won against the dollar. Additionally, geopolitical risks can affect currency strength; thus, traders and investors need to stay informed about global events that could impact currency values.

To illustrate these fluctuations effectively, graphical representations or tables showing historical exchange rates over the past few months provide visual context. Such charts reveal trends that may indicate whether the won is appreciating or depreciating against the dollar. For instance, if investors observe a rising trend in the exchange rate—pointing towards an increase in the value of 45.6 billion won to usd—they may consider it a favorable moment to exchange their currency. In contrast, a declining trend may lead investors to hold off on conversions until market conditions improve. By keeping a close watch on these movements, one can better navigate the complexities of currency conversion and its financial implications.

Calculating 45.6 Billion Won to USD

Converting 45.6 billion won to USD involves utilizing the current exchange rate to achieve an accurate financial representation. The value of the Korean won fluctuates regularly, influenced by various market factors and economic indicators. Therefore, it’s essential to use an up-to-date exchange rate for calculations. The formula to convert won to USD is relatively straightforward:

Converted Amount (USD) = Amount in Won / Current Exchange Rate

To illustrate this conversion, let’s assume that the current exchange rate is 1,300 KRW (Korean won) per 1 USD. To calculate the equivalent amount in USD:

Converted Amount (USD) = 45,600,000,000 KRW / 1,300 KRW/USD

Performing the calculation:

Converted Amount (USD) = 35,076,923.08 USD

This means that 45.6 billion won would be approximately 35.08 million USD at the given exchange rate. It is important to note that the exchange rate can vary depending on where you check it. Consequently, for the most accurate and favorable conversion, consider utilizing reliable online currency converters, which often provide near real-time data. Additionally, consulting with financial institutions or currency exchange specialists can yield better rates if you are planning for significant transactions.

Furthermore, it is prudent to remain aware of the implications of exchange rates on your final amount, as fluctuations may occur during the time of conversion. Keeping track of the current trends in the currency market can help in making informed decisions, especially when dealing with substantial sums such as 45.6 billion won converted to USD.

Financial Implications of the Conversion

The conversion of a significant sum such as 45.6 billion won to USD carries multifaceted financial implications. Understanding these implications is essential for both individuals and businesses engaged in international transactions. One critical aspect is the impact on investment decisions. Currency fluctuations can influence the return on investments, so individuals or corporations converting large amounts may need to assess the current forex market conditions and trends. Financial analysts often recommend timing conversions during a favorable exchange rate environment, which could lead to more USD gained from the same won amount.

Additionally, differences in purchasing power between South Korea and the United States can also affect decisions following conversion. The value of money does not solely depend on nominal exchange rates but also on the relative cost of living and price levels in both countries. For example, while 45.6 billion won might seem substantial, the U.S. dollar’s purchasing power could render that amount less critical in contexts such as investment in U.S. assets, real estate, or operational costs—especially for expatriates or businesses. Understanding localized economic conditions can help stakeholders make informed choices regarding their financial resources.

Furthermore, businesses operating in multiple currencies need to consider the implications of currency conversion on their financial health. Cash flows, pricing strategies, and profit margins could all be impacted as they navigate between won and USD. Organizations must also stay abreast of potential regulatory changes surrounding currency conversion, which could affect how and when they convert funds. By evaluating these aspects and employing analytical tools, individuals and companies alike can optimize the conversion process, ensuring their financial goals are adequately met while minimizing risks associated with currency fluctuations.